njtaxation.org property tax relief homestead benefit

File Online or by Phone. Property tax relief programs.

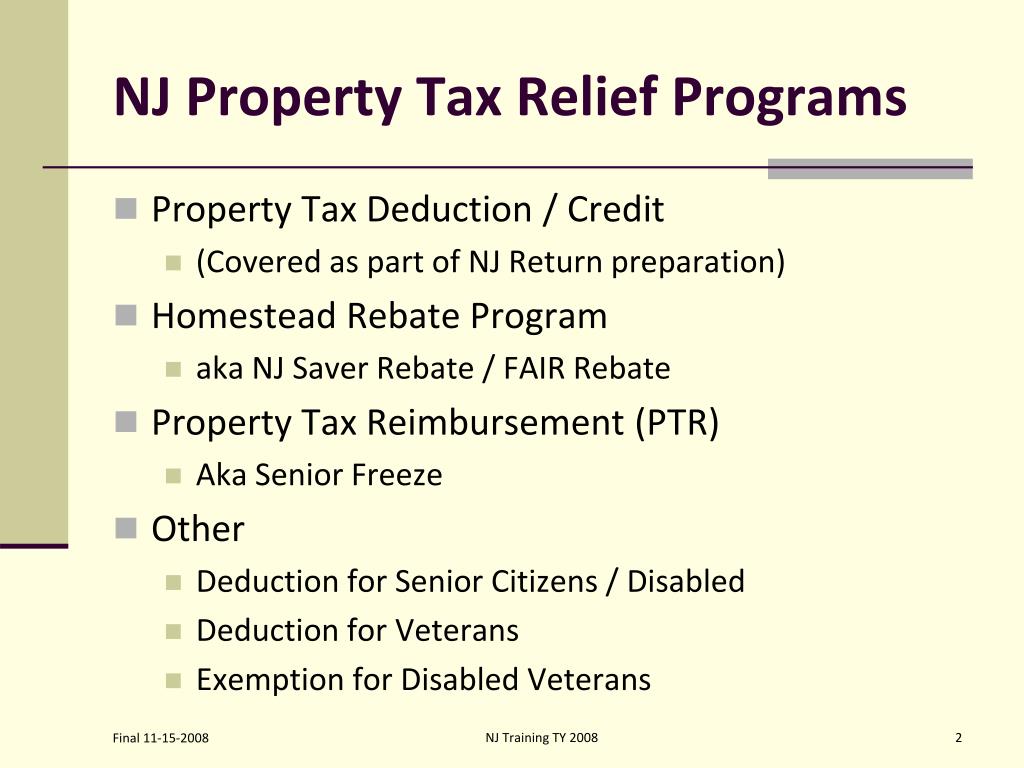

Nj Property Tax Relief Programs Mendham Borough

For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

. All Property Tax Relief Benefits are Subject to Change NJ FY 2019 Budget Passed July 1 2018. 75000 for homeowners under 65 and not blind or disabled. You can file for a Homestead Benefit regardless of your income but if it is more than the amounts above we will deny your application.

But to save money amid the COVID-19 crisis New Jersey suspended its homestead rebate program in. 1-877-658-2972 When you complete your application you will receive a. You may not have the Adobe Reader installed or your viewing environment may not be properly.

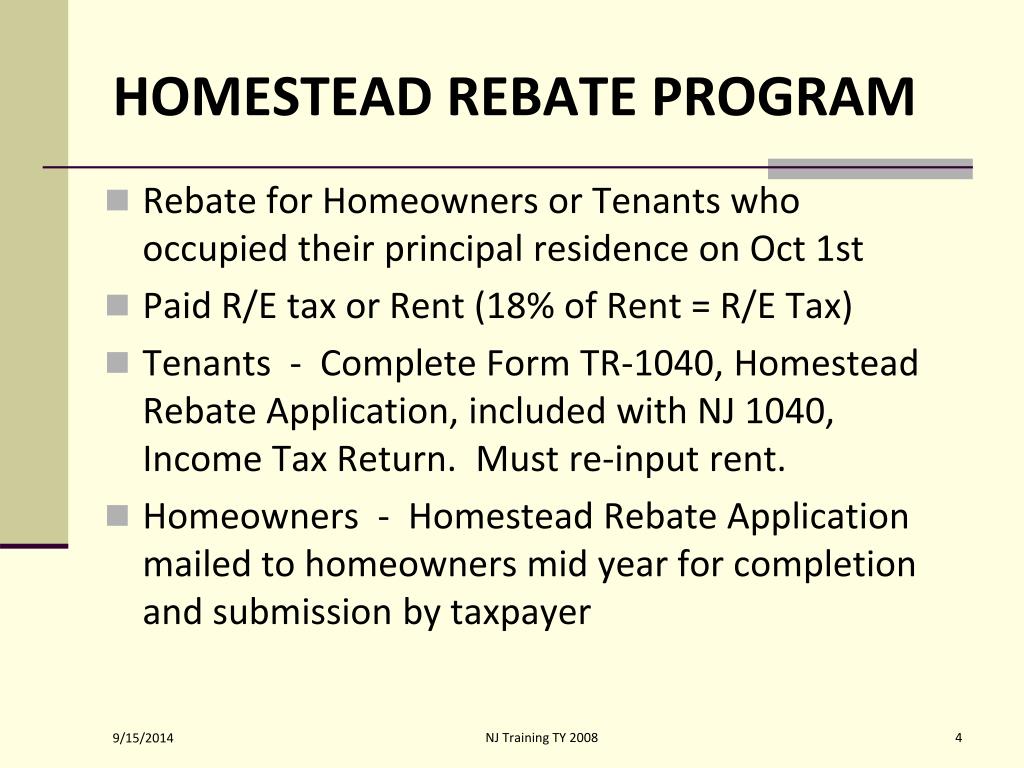

How to File for Property Tax Relief and Check Your Status. For that years benefit you had to be a New Jersey resident who has owned and occupied a home in NJ that was your principal residence as of Oct. Eligibility requirements including income limits and benefits available under this program are subject to.

Forms are sent out by the State in late Februaryearly March. Homestead Benefit Program Homestead Rebate The Homestead Benefit program provides property tax relief to eligible homeowners. Senior Freeze Property Tax Reimbursement Program.

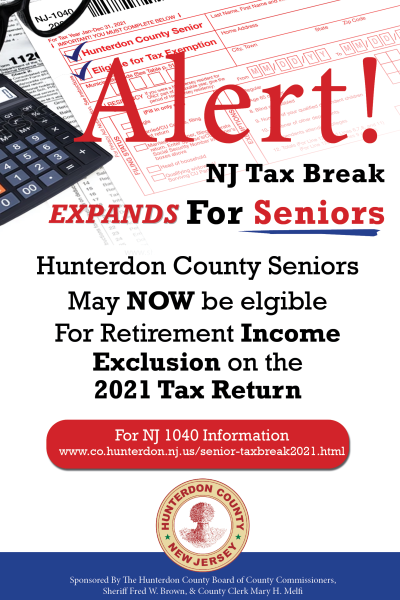

Property Tax Relief Programs. Online Inquiry For Benefit Years. A 250 yearly deduction is available for senior citizens disabled persons and surviving spouses of a senior.

Property Tax Relief Programs. Your tax collector issues you a property tax bill or advice copy reflecting the amount of your benefit. The total amount of all property tax relief benefits you receive homestead benefit senior freeze property tax deduction for senior citizensdisabled persons and property tax deduction for veterans cannot be more than.

The main reasons behind the steep rates are high property values and education costs. March 2020 that it would freeze 900 million in planned expenditures including nearly 142 million tabbed for the homestead benefit program. The deadline for filing for the 2017 Homestead Rebate was December 2 2019.

The NJ Homestead Benefit reduces the taxes that you are billed. Compare search please select at least 2 keywords. When you report your property taxes paid you already account for this benefit.

For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did. New Jersey property tax keeps climbing. Jan 24 2022 For example Murphys tax record includes the modernization of the Homestead Benefit.

1-877-658-2972 toll-free within NJ NY PA DE and MD 2018 benefit only. Search here for information on the status of your homeowner benefit. You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018.

Tax Income Verification Benefits. Senior citizen disabled person and surviving spouses receive an annual post tax year income. Call the Senior Freeze Hotline.

You can get information on the status amount of your Homestead Benefit either online or by phone. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022.

Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219. Homestead Benefit Online Filing. Check or Direct Deposit.

If a benefit has been issued the system will tell you the amount of the benefit and the date it was issued. The NJ homestead rebate program provides property tax relief to Garden State homeowners. The document you are trying to load requires Adobe Reader 8 or higher.

Roots in the Great Recession. Most recipients get a credit on their tax bills. 2016 2017 2018 Phone Inquiry.

This years shorting of Homestead benefits would come after the average New Jersey property-tax bill rose last year by nearly 160 year-over-year to a record high of 9112 according to the most recent data from the New Jersey Department of Community Affairs. Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ tax returns. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

But the longstanding practice that resulted in the annual shortchanging of Homestead recipients was initially enacted as a cost-saving measure more than a decade ago during the 2007-2009 Great Recession. If you need to check the status of your homestead benefit for benefit years 2016 2015 or 2014 click hereTo check the status of your homestead rebate for 2017 call 877-658-2972. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax.

Credit on Property Tax Bill. The system will also indicate whether the benefit was applied to your property tax bill or issued as a check or direct deposit to your. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021.

Have a copy of your application available when you call. To file an application by phone1-877-658-2972. 1 2016 and your property taxes must have been.

That round of benefits offsetting tax year 2017 property-tax bills was eventually paid out in May 2021. Applications for the deduction can be obtained from the City of Elizabeth Tax Assessors Office.

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Don T Forget To File Your Homestead Exemption Your Application Must Be Applied For On Or Before April 29 Real Estate Investing Homesteading Dallas Real Estate

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099

Property Tax Relief Programs West Amwell Nj

Memoli Company Pc Home Facebook

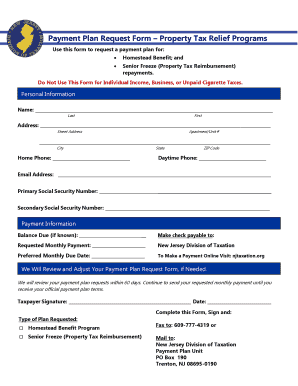

Fillable Online Payment Plan Request Form For Property Tax Relief Programs Fax Email Print Pdffiller

Nj Property Tax Relief Program Updates Access Wealth

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

Property Tax Relief Programs West Amwell Nj