colorado estate tax exemption

Up to 25 cash back The homestead exemption is 105000 if the homeowner his or her spouse or dependent is disabled or 60 years of age or older. Federal Estate Tax Exemptions For 2022.

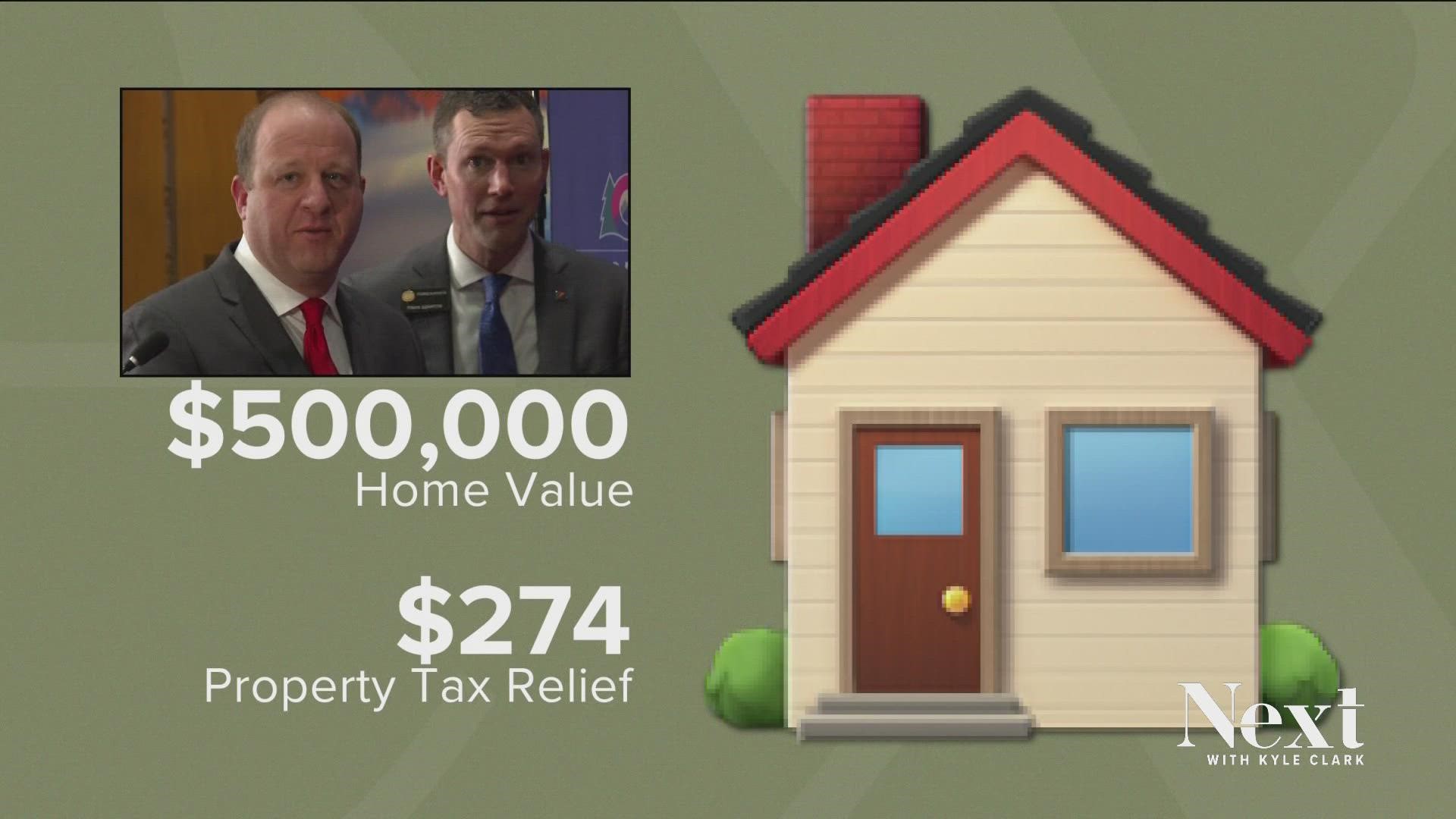

Soaring Home Values Mean Higher Property Taxes

The tax year for which you are seeking the exemption.

. This tax is portable for married couples. The following are the federal estate tax exemptions for 2022. For the purpose of the exemption you are also considered an.

If you own a house worth 120000 and you have a mortgage balance of 80000 you have 40000 of equity in the property. Hotel or Motel Mixed Use Questionnaire. According to the Act if you sell your primary residence you are exempt from capital gains taxes on the first 250000 of profit 500000 if married filing jointly.

The median home value in Colorado is 427659 so a buyer would owe a documentary fee of. This tax is paid to the county clerk and recorder in the county where the property changes hands. 2021-2022 92 - Social Security Income Exemption from State Income Tax.

When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. For tax years 2022 and later the Colorado income tax rate is set at 455. It is one of 38 states with no estate tax.

Colorado or any other state for that matter. If you have not received an annual report and instructions by postal mail by March 15 2022 please contact Exemptions at 303-864-7780 and provide your file number see previous years form and updated mailing address. The tax year for which you are seeking the exemption.

From Fisher Investments 40 years managing money and helping thousands of families. In 2018 this fee was increased to 002 per 100 of property value. While its not called a real estate transfer tax in essence thats exactly what it is.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. The estate tax is a tax applied on the transfer of a deceased persons assets.

In 2002 the state granted 123380 exemptions and paid counties about 62 million in lost tax revenue. For the 2020 tax year Coloradans. Homeowners who are disabled veterans as defined in OCGA.

Married couples can exempt up to 234 million. Forms are mailed by March 1. For the 2020 tax year Coloradans claimed nearly 270000 exemptions totaling nearly 158 million in county taxes that had to be backfilled by the state.

This past month Senator Bernie Sanders introduced his estate and gift tax reform legislation to lower the estate tax exemption to 3500000. The exemption for that tax is 1170 million for deaths in 2021 and 1206 million in 2022. The following documents must be submitted with your application or it will be returned.

There are two main types of bankruptcy for individuals. Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000 Government Assisted Housing Questionnaire. Individuals can exempt up to 117 million.

Attach a copy of your Federal Determination Letter from the IRS showing under which classification code you are exempt. They will average around half of 1 of assessed value. Federal legislative changes reduced the state death.

On average a qualifying applicant saved 585. Colorado seniors are eligible for a property tax exemption if they are. Note however that the estate tax is only applied when assets exceed a given threshold.

The deadline to file a 2022 Exempt Property Report is April 15 2022. If the return is filed on paper the total from the Deductions schedule must be reported on the sales tax return and the Deductions schedule must also be submitted with the sales tax return. You must provide legally required documentation.

48-5-48 are entitled to a 81080 exemption on school and state taxes and an 119080 exemption on county and fire taxes. Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicated. You can own it with your spouse or with someone else.

Have been the primary occupant for at least ten consecutive years prior to January 1. Taxpayer Relief Act of 1997. The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing bankruptcy.

Federal legislative changes reduced the state death. A property tax exemption is available for senior Colorado residents or surviving spouses provided they meet the requirements. Thats especially true for any situation involving surviving children and a spouse.

Corporate partnership or other entity for estate planning purposes. No more than one exemption per tax year shall be allowed for a residential property even if one or more of the - owner occupiers qualify for the senior exemption and theboth disabled veteran exemption. Do you make more than 400000 per year.

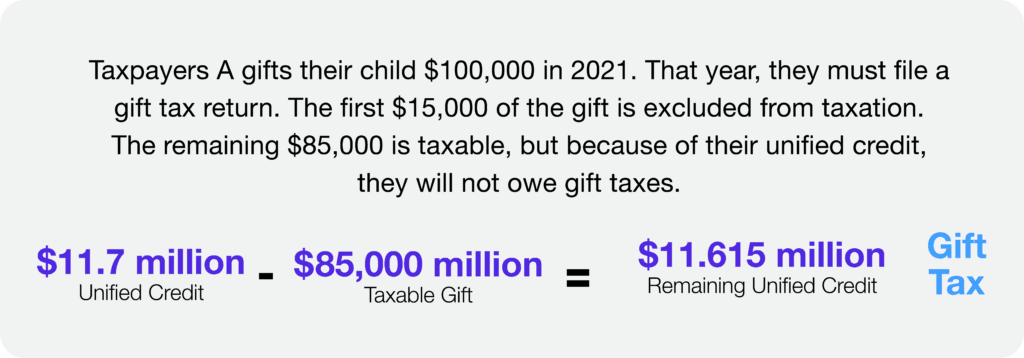

The annual gift exclusion is 15000. The Colorado Homestead Exemption allows one to exempt up to 75000 of their real property value when filing bankruptcy. State wide sales tax in Colorado is limited to 29.

Are the current property owner of record. The average tax savings totaled 503. Over time the federal laws surrounding estate and gift taxes have been alteredoften with the change in administration.

The property need only be declared exempt once and that declaration. Even though there is no estate tax in Colorado you may still owe the federal estate tax. Property taxes in Colorado are definitely on the low end.

These values may also be impacted by gifts that you make during your lifetime. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. A state inheritance tax was enacted in Colorado in 1927.

Estates of individuals who are included within this category are nearly exempt from. This exemption applies to all tax categories. Chapter 7 bankruptcy is typically applied to lower income individuals and involves liquidating your assets to pay off your debt.

Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. There is no estate tax in Colorado. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted portion of the property tax The.

At least 65 years old on January 1 of the year in which he or she qualifies. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. Colorado Estate Tax.

A state inheritance tax was enacted in Colorado in 1927. Property taxes assessed during any tax year prior tothe year in which the veteran first files an exemption application. Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715.

Only organizations exempt under 501 c. The eligible senior spouse or surviving spouse is confined to a nursing home hospital or assisted living facility. If you file a Chapter 7 bankruptcy you can use the Colorado homestead exemption to.

You can also own a life estate in the property If Your Spouse iswas the Owner of Record. One of the new laws HB-1311 will eliminate certain state tax deductions for individuals and households with higher. For Coloradans with an estate plan in place this may affect them.

In other words when an estate is passed on the federal government taxes the transfer. Chapter 13 bankruptcy although similar. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is based on this credit.

The Taxpayer Relief Act of 1997 exempts most homeowners from paying capital gains tax on the profits from selling their homes. Lets find out. You do not have to be the sole owner of the property.

Whose tax payments may increase. For 2021 this amount is 117 million or 234 million for married couples.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

A New Era In Death And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Talk To Clients About Estate Taxes Lifetime Gifts Corvee

Colorado S New Property Tax Relief Bill Won T Actually Cut Taxes El Paso County Assessor Says Subscriber Only Content Gazette Com

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Tax Inheritance Tax In Colorado

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Lawmakers Unveil Bill That Would Cut Colorado Residential Property Tax Rates For 2 Years

County Commissioners Approve Resolution Supporting The Homestead Tax Exemption El Paso County Assessor

How Do State Estate And Inheritance Taxes Work Tax Policy Center

A New Era In Death And Estate Taxes

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Tax Preparer Resume Example Template Minimo Resume Examples Professional Resume Examples Job Resume Examples

Polis Announces Efforts To Cut Property Taxes In Colorado 9news Com